Inspirational journeys

Follow the stories of academics and their research expeditions

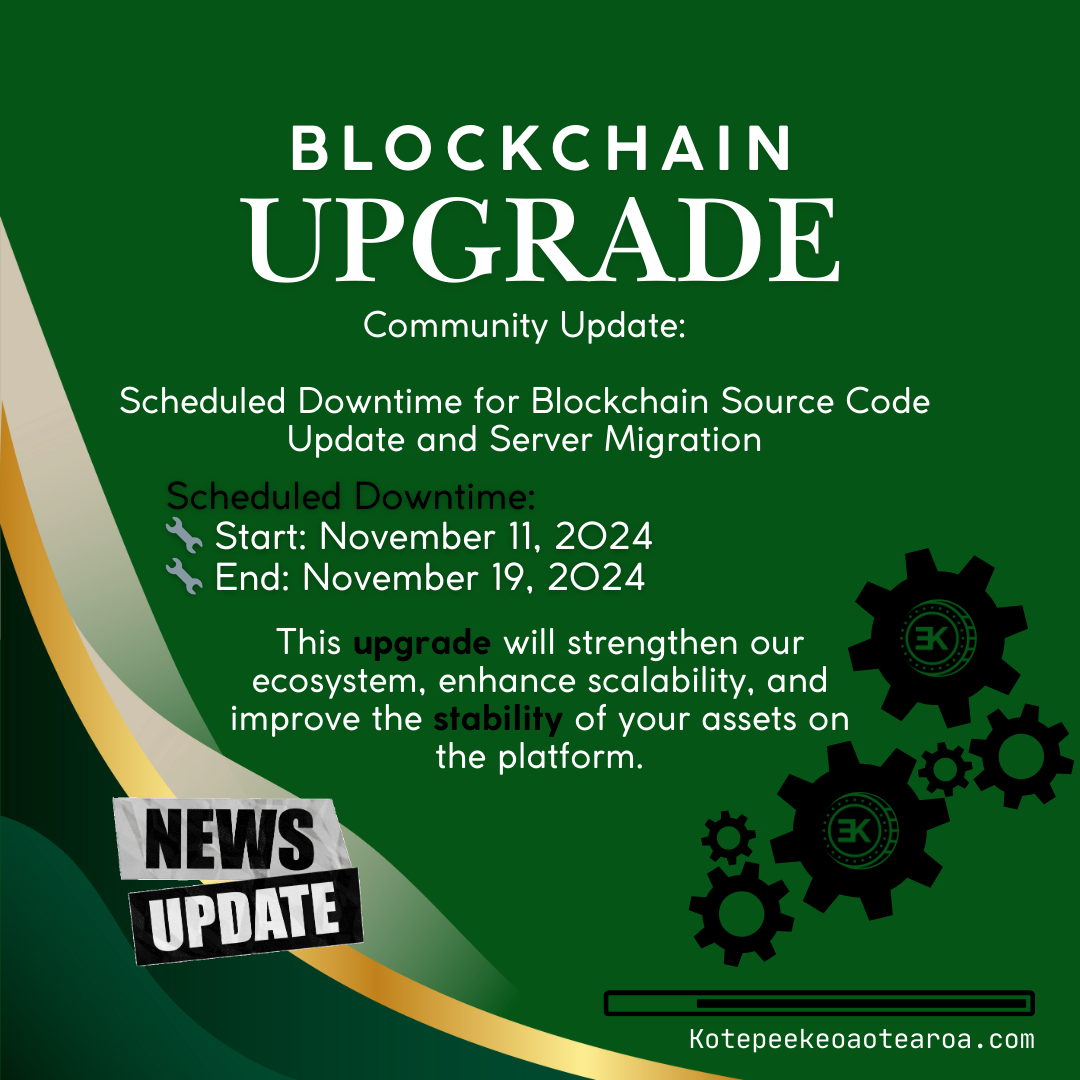

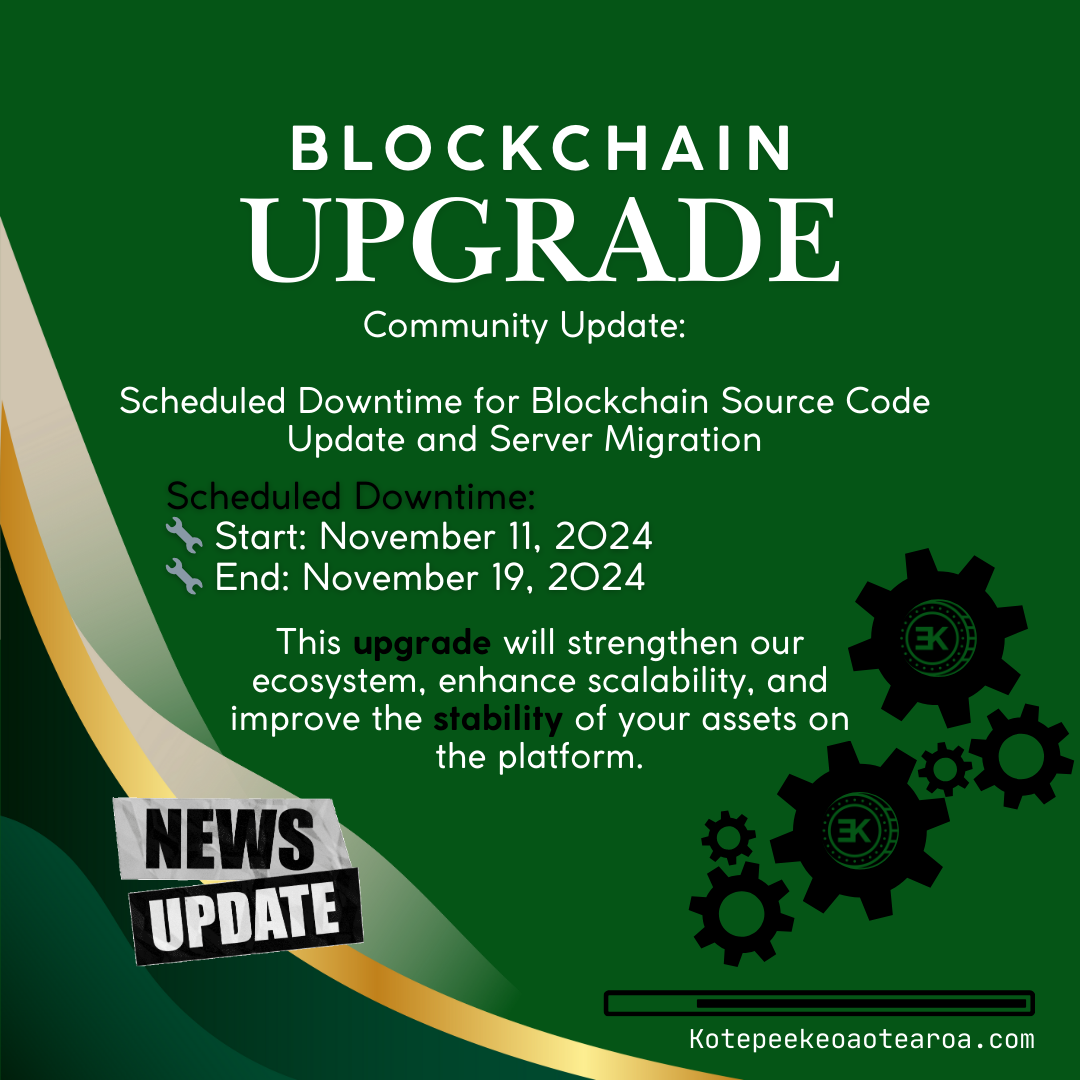

Strategic Wealth Building with Ko Te Peeke O Aotearoa

Ko Te Peeke O Aotearoa: Overview of the Sovereign Bank's Blockchain Infrastructure

Ko Te Peeke O Aotearoa (The Bank of Aotearoa) is carefully designed to integrate the best of Web2 and Web3 technologies. It uses oracles to connect real-world data with on-chain smart contract protocols, allowing for a seamless integration of traditional and decentralized financial services. This system is focused on providing high-net-worth solutions, enabling clients to transition from middle to high-net-worth through structured family estate planning and innovative financial management. It also emphasizes strategic cash plays and investment vehicles to support wealth growth in today’s economic landscape.

Core Features and Components

Treasury Management

- Centralized Fund Control: The treasury serves as the central asset management hub, automating the allocation, management, and oversight of funds within the bank.

- Automated Compliance: It ensures adherence to predefined rules for asset allocation and investment strategies, simplifying the process of complying with financial regulations.

- Liquidity and Risk Management: The treasury also supports liquidity management by maintaining reserves for withdrawals and managing risks through asset diversification.

- Integration with the Portfolio Dashboard: Data from the treasury feeds directly into the investment portfolio dashboard, providing real-time updates on staked assets, investments, and other holdings.

Automated Accounting System

- Expense Tracking and Fund Disbursement: This system simplifies the tracking of expenses and manages cash flow, making fund disbursements more efficient.

- Detailed Financial Reporting: It offers comprehensive reports on transactions, account balances, and asset appreciation or depreciation.

- Integration of Digital and Real-World Assets: It manages cryptocurrency transactions and tokenized real-world assets, bridging the gap between traditional and decentralized finance.

- KYC/AML Compliance: The accounting system is integrated with Know Your Customer (KYC) and Anti-Money Laundering (AML) mechanisms, ensuring that user activities comply with international regulations.

Peer-to-Peer Lending and Staking Platform

- Decentralized Lending: Clients can lend assets in a decentralized environment, creating microloans that offer higher returns.

- Blockchain-Based Credit Scoring: Users can build a blockchain-based credit score through their participation in the lending ecosystem, which allows access to more favorable loan terms.

- Staking and Yield Generation: Users can stake cryptocurrencies or tokenized real estate assets, earning stable tokens as rewards.

- Microloan Pool and Interest Generation: By lending stable tokens, users can earn interest from the microloan pool, contributing to the overall liquidity of the system while diversifying their income streams.

Investment Portfolio Dashboard

- Real-Time Portfolio Tracking: This dashboard provides users with a comprehensive view of their holdings, including performance metrics for digital and tokenized real-world assets.

- Document Generation for Proofs: It includes an automated document generator that compiles performance data into professional PDF reports, which can serve as proof of funds, proof of wealth, or proof of coin.

- Customized Report Generation: Users can tailor reports to focus on specific assets, relationships, or contract performance while keeping other information confidential, meeting KYC/AML requirements.

- Failsafe Mechanisms and Risk Mitigation: The dashboard includes built-in mechanisms that allow users to set parameters for their investments, ensuring automatic actions during market changes to mitigate risks.

- User-Friendly Interface: Designed for both beginners and experienced investors, the dashboard presents data in easy-to-understand charts and graphs, helping users make informed financial decisions.

PDF Document Generator with AML/KYC Compliance

- Comprehensive Data Inclusion: The generator ensures that reports include all required information for KYC/AML purposes, such as identity verification, proof of address, source of wealth, and transactional history.

- Automated Verification Processes: The generator pulls data from the treasury, accounting system, and investment dashboard to create a report that meets the needs of financial institutions, making it easier for users to open new accounts or engage in high-value transactions.

- Professional and Secure Document Management: Generated reports are professionally formatted, with options for secure sharing and branding customization, making the process of presenting financial status to stakeholders more efficient and credible.

Strategic Focus and User Benefits

Ko Te Peeke O Aotearoa aims to support clients in transitioning from middle to high-net-worth status through the strategic use of family office structuring, structured estate planning, and private banking. By leveraging investment vehicles and cash management strategies, the bank assists users in building substantial and sustainable wealth. The bank is committed to integrating decentralized solutions with traditional financial tools, enabling clients to manage both digital and tangible assets through a single platform, making it easier to navigate today’s digital economy.

Leave a comment